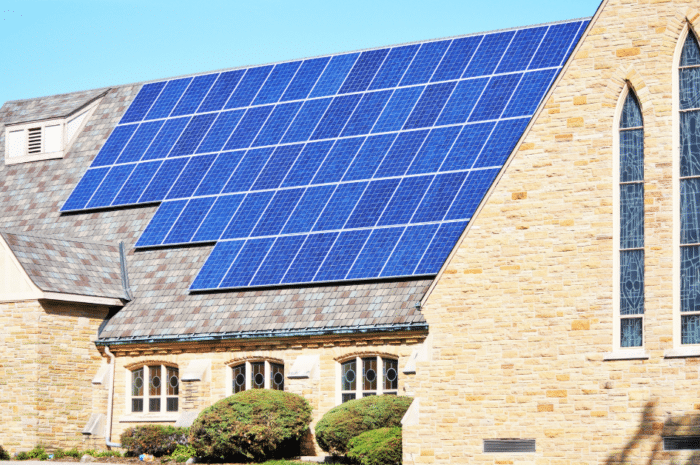

Going Solar

Churches Can No Longer Afford to NOT Go Solar

Many congregations that own their own building can

no longer afford to not go solar for five reasons:

1. The federal government will pay for at least 30% of the cost of a solar installation, if not 40 to 50%, depending upon where a church is located and whether domestically produced materials are used. (Technically, one could have 80% of a solar installation covered, if one additionally received funds through competitive processes.)

2. Solar will reduce one’s electrical bill. This is especially true when a church maximizes the environmental and financial impact of going solar by increasing its energy efficiency and conservation.

3. Even if a congregation does not have the funds to pay for the upfront costs of going solar, the Cornerstone Fund can provide financing that will enable a congregation to reduce its overall costs. (The Creation Care Loan currently has a reduced interest rate of 5%).

4. Even if a congregation does not want to purchase or finance a solar system, it can still go solar by partnering with an investor who pays for the system and gives the congregation (and possibly low income neighbors as well) a discount on electricity–typically around 10-20% off one’s monthly bill.

5. Finally, even if a congregation has absolutely no interest in saving money on electricity, so that more money can be spent on ministry, going solar is one important way to reduce pollution and live out our first calling as Christians: to care for God’s creation.

Quick Links:

Do you have a historic church with a roof that simply will not allow for solar panels? Consider alternatives: solar parking lot canopies, ground mounted solar panels, or subscribing to a community solar garden.

If going solar makes financial and spiritual sense to you, below here are some resources to help.

How Do the Incentives Work?

As a result of the Inflation Reduction Act, churches are now eligible to receive a direct payment from the federal government for solar installations for at least 30% of the cost of a solar installation. There are added incentives that can increase this percentage. For example, if one’s church is located in what the government calls an “Energy Community,” the tax credit goes up to 40% of the solar system’s total costs, including hardware, labor, and inverters. Energy Communities are identified by the government according to data on the environmental and economic characteristics of a community. Creation Justice Ministries has created an online map that identifies UCC churches that qualify.

A church can also receive an additional 10% payment from the government if the solar installation uses domestically sourced materials. A church would want to talk with its solar installer to determine if this is possible.

While the previously mentioned bonus payments are automatically awarded as part of the direct payment from the IRS, separate competitive application processes can garner further payments. A church may receive an additional 10% payment for being in a low income community or on tribal land. (Geographic areas covered by this incentive are determined in a different manner than the Energy Communities, but the two areas may overlap.) Furthermore, a church may receive an additional 20% payment if the solar panel system provides an economic benefit to low income households.

Direct payments from the government are also available for charging stations, combined heat and power systems, and geothermal heat pumps. Installations of air-source heat pumps that involve an architect or engineer can additionally benefit from incentives. On October 25th, the UCC co-hosted a webinar on how heat pumps work and the government incentives related to them. Watch it here!

How Does One Get Paid?

Payments from the IRS will not be made until after the solar installation is complete. A church will need to register with the IRS and receive a registration number before filing to receive payment. Churches that put into service solar panels or battery storage in 2023 can now register via this online portal. During this registration process, a church will need to provide information about the church, its solar project, and the credits it wants to receive. Additional bonus credits for being located in a low income community or providing an economic benefit to low income households have a separate competitive application process. Utilize these resources to learn more about this:

Map for Determining Eligible Low Income Communities

Overview of the Low-Income Communities Bonus Credit Program

Application Portal

Video on Preparing to Apply

The UCC National Setting will provide guidance on how to document one’s 501c3 status as soon as more information about the requirements becomes known. For a deeper dive into what is currently known about the payment process, check out this article by the Environmental and Energy Study Institute.

Where Can We Get Financing for Solar that Actually Saves Us Money?

The UCC-affiliated Cornerstone Fund has a special program to give a reduced rate on solar installations as well as energy efficiency improvements. The current interest rate for this fund is 5%. The money that a congregation saves on electricity bills by switching to solar more than covers the cost of the interest rate. In relation to the Inflation Reduction Act, it is worth noting that a loan from the Cornerstone Fund can also serve as a financing bridge until a direct payment is received from the IRS. New and renewing churches can also be in touch with the UCC’s Church Building and Loan Fund which additionally has an energy and environmental loan program.

Explain How a No-Cost Solar Installation Could Happen

If a congregation does not want to purchase or finance solar panels, it can partner with an investor who pays for the solar system and sells the electricity to the congregation at a discounted rate–often around 10% less. This arrangement is called a Power Purchase Agreements (PPA) and is currently available in 29 states. The investor benefits from the federal tax credit and incentives, while the congregation lives into a new way to care for creation and reduce its electrical bill. Often solar installers will offer these agreements. Organizations like CollectiveSun can additionally help your church explore this and similar options.

Your Solar Resource Clearing House

Don’t stop with federal government incentives. See if there are other incentives from which your church can benefit by exploring this database of state programs. Also, check with your utility to see if it has an incentive program.

Grants for solar panels are rare, but at least one UCC church has received a grant from the Hammond Climate Solutions Foundation’s Solar Moonshot Program.

Read the inspiring story of Peace Dale Congregational Church as their congregation became energized by the sun.

Be community minded by joining or promoting a solar co-op. Solar United Neighbors brings together interested homeowners, businesses, and faith communities to educate them about solar and leverage their bulk purchasing power to secure the most competitive installation pricing in the area. When you think of all the church members and members of the broader community that could be inspired to add solar to their homes and businesses, churches can play a tremendous leadership role in reducing an entire community’s carbon footprint.

When your solar installation is finally complete, celebrate it in worship. Hold a special “Sun-Day” Service! Check out this sample liturgy.

What Is Community Solar? Where Can It Be Found?

Help make solar possible for other churches by investing in a special program created by the Cornerstone Fund.

List of UCC Churches that have gone solar.

Questions?

Please contact The Rev. Brooks Berndt,

Minister of Environmental Justice. 216.736.3722 berndtb@ucc.org

Learn more about Brooks here.